FAQ

If both you and the recipient have a bank account, GlobalWebPay is meant for you.

The service is low cost, secure and fast

Fees from just £1 for local currency payouts

Fees from just £4.75 for SWIFT payouts

Better foreign exchange rates than most high street banks

No hidden fees - such as correspondent or recipient fees for local payouts

For a local currency payout it costs from just £1 to make a transfer using GlobalWebPay to 201 countries worldwide. We charge from just £4.75 for all SWIFT payouts, e.g., USD, EUR or GBP payments.

For all local currency payouts, what we send is what the recipient gets. There are no hidden foreign exchange, recipient or withdrawal fees

Please Note: SWIFT payouts are subject to the recipient bank charging a correspondent/recipient fee, which they deduct from the recipient’s account. You should get your recipient to check with their bank before setting up a payment so you can include extra funds to cover the possible fees.

This is outside of our control unfortunately and is a feature of the international banking environment.

We offer better foreign exchange rates than most high street banks and when we you accept a quote for an amount of currency, that is what we send. Unlike some other suppliers, we don’t ask you for a “rate deposit” fee or “buffer” to cover their risk of rate movements.

GlobalWebPay charges you a flat fee per transaction regardless of how much you send.

The security of customer money is very important to GlobalWebPay. Your money never leaves the banking system and is transferred using only the largest and most established banks in each territory.

Global Web Pay Limited is authorised by the Financial Conduct Authority (FCA) under the Payment Service Regulations, 2009 for the provision of payment services. FCA Registration Number FRN 631844. Global Web Pay Limited is licensed and regulated by HMRC as a Money Services Business (MSB) License Number 12627384.

Funds you transfer to us are kept in our segregated client accounts with our banks and/or with our payment outsourcing partners. Once payment is received it is converted and paid out very quickly to the local bank in the destination country so does not remain in GlobalWebPay's bank accounts for more than it takes us to process the order.

In certain territories GlobalWebPay outsources its banking payments to its partners. These partners are banks or other payment institutions who run a network of bank accounts around the world and process millions of customer’s transactions each month. Where we use bank accounts owned in a partner’s name, the payment to your beneficiary may show “Partner name” – e.g., “WorldPay AP” as the sender on your bank statement.

GlobalWebPay is available to anyone over the age of 18 or a business who has a bank account in one of our supported territories – currently only the UK. Simply register for your easy access, secure GlobalWebPay account today, and you could be making your first low cost, next day international payment within minutes.

No formal documentation is required to make your first GlobalWebPay transactions if your identity is verified via our automated checks that take place in the background against publicly available databases such as the UK Electoral Roll etc. If you register with the correct name, date of birth and address details you should be verified immediately and be able to make payments immediately. We may also request documentation if your first payment is over £2,000.00, or for some other reason that our compliance team may deem necessary, such as currency or the destination country of your payment.

If you are not automatically verified, you will receive an email letting you know and then you simply need to send us smartphone photos or scanned copies of two documents such as a passport or photo UK driving licence together with a recent bank statement or utility bill. Due to the legislation regarding the proceeds of crime, money laundering, and terrorist financing, we must verify the identity of all of our customers. This regulation greatly increases the security and reliability of all money transfer transactions and helps us to protect all our client's interests.

We will need clear, readable copies of the two required documents, which you can email to us. They must be complete scanned or smartphone photographs of the documents, showing all the page and all edges.

For business customers we will ask for the above documentation relating to the Directors. We will also ask for documentation confirming the business address and some additional information about the company such as the company registration number and any URLs the company utilises.

You can see more about this topic in our Compliance section within our Terms and Conditions

It can take no more than 10 minutes to sign up for your GlobalWebPay account, set up a payee and make your first payment. You can store payee details so that in future you will quickly be able to make additional payments to them.

1. You register online with GlobalWebPay

2. You set up payment instruction(s) on the GlobalWebPay site

3. You provide us with the money you wish to send

4. We then make the payment(s) on your behalf to your chosen recipient

5. Funds are typically received by the recipient within 3 working days but often the next working day

Currently we only allow UK residents to send money and we only allow GBP into our UK collection account(s). We have plans to expand our coverage to other European countries and we will keep customers informed on this website.

You can send money in local currency using GlobalWebPay to many of the countries shown on our coverage page.

Where local currency payments are not possible, we can make payments in international currencies including USD, EUR and in some cases GBP to all the countries below.

Clicking this link below will take you to our current coverage page. Once there you can select the country and you will be shown what currencies we are able to send to each one:

https://www.globalwebpay.com/coverage

Should you have a requirement to make payments to countries or in currencies not on the above list please get in touch.

Payment methods vary depending on country. From the UK will be able to use one or more of the following payment methods

- UK Faster Payments bank internet transfers sent before 17:00 with the correct GWP reference should normally reflect the same day otherwise next day

- UK issued Debit card.

Please note: We do not accept credit cards

We do not accept cash over the counter at a bank branch or a cheque and will not process orders funded in this way. GlobalWebPay will provide you with the appropriate bank details and a unique reference number required when making bank transfers.

With Vyne’s payment experience, there’s no need to enter card details or search for security pins. It’s as easy as one, two, three.

One: Checkout with Vyne

Two: Choose your bank and log in to banking app

Three: Authorise the payment. Done.

It is a bank-to-bank transfer. You provide GlobalWebPay with the money you wish to send, using a debit card or bank transfer. Once we have received the funds, we make a bank transfer on your instruction to the recipient using the most appropriate GlobalWebPay account.

This will depend on the country you are sending to and when we receive your funds. Once your payment status changes to PAYOUT COMPLETED the recipient should typically receive the money the next business day. In some countries, payments can be received same business day, e.g., if a EURO, PLN, DKK, HUF or SEK payment changes to PAYOUT COMPLETED during the morning, the recipient should normally receive payment the same business day. PKR payments are normally delivered within 2 hours during normal business hours (09:00 to 17:00) - faster if to a Bank Alfalah account.

However, in some instances payments can take up to 3 working business days. This will vary due to both UK and local bank holidays. Transfers could take longer due to any of the following factors: deposit method, transfer method (local or SWIFT), bank cut off times and clearing cycles of recipient banks.

Deposit Method

- Local bank transfer:

- UK Faster Payments / internet bank transfers sent before 17:00 will reflect in your account balance that business day, or next business day if not. If sent after 17:00, they will reflect next business day

- BACS can be up to 3 business days - we don't recommend this older method as orders will expire before funds are received.

- Payments by the Vyne banking App are reflected instantly.

- Debit card funding is reflected instantly once authorisation is confirmed.

Bank Cut Off Times

- Payments we receive before 12:00 GMT we aim to process that same business day or next business day if not

- Payments we receive after 12:00 GMT will be usually processed the next business day

Recipient Bank Clearing Times

- Banks should reflect transfers the same business day they receive them

- However, in some cases banks will reflect transfers next day

- Times are affected by local bank holidays in the recipient's country

You can log into your GlobalWebPay account and check the status of your order. There are several possible statuses:

- Open – Order open, payments can be added.

- Pending – Order has been checked out.

- Complete – Order is complete, payments have been paid out.

- Deleted – Order (and the payments within) has been deleted.

- Unpaid – Order has been cancelled and can now be checked out again.

- Funded – Awaiting payout at GlobalWebPay

- Expired – Payments within the order have expired

You can also log into your GlobalWebPay account and check the status of any single payment. There are several possible statuses:

- New – Payment has been entered but is not checked out or funded

- Deleted – Payment has been deleted.

- Awaiting Funding – Payment is checked out, but funds haven’t yet been received

- Awaiting Payout – Funding received and payment is in the next batch awaiting payout

- Complete – Payment is with GlobalWebPay's bank on its way to or with the recipient

- Payout Confirmed – Recipient has acknowledged receipt of payment by the recipient

- Expired – Payment has expired as funds have not been received in the required time (typically within 4 hours of the original order being created).

- Payment Reversed – Payment is in error and has been rejected before being sent

- Payment Returned – Payment has been returned by the recipient’s bank

You can provide GlobalWebPay with the money you wish to send in your currency, and we will convert it and send it to the recipient’s account in that chosen currency. This is known as foreign exchange.

Before you make a payment, we provide you with a table showing:

- The amount of currency you are sending

- How much currency the recipient expects to receive

- The foreign exchange rate you will receive

- The transaction fees you will be charged

- The total amount that you need to pay

You can use the cost calculator tool on our website to help you to work out how much you need to send and how much will arrive.

If you are funding the payment using a bank transfer it is crucial that you send the required funds to GlobalWebPay – as per the payment instructions – there and then. Any delay may mean the foreign exchange rate cannot be guaranteed. As a result, we may show the payment as “Expired”, since exchange rates can change quite significantly day to day. In this case you will need to review the payment in your GlobalWebPay account and then re-order the payment at the then active exchange rate.

Foreign exchange rate is the equivalent of one currency when converted into another currency.

Foreign exchange is any flat fee charged by a provider to convert money from one currency to another

Foreign exchange spread is the margin that providers apply either side of the foreign exchange rate they receive. They do this to protect themselves from fluctuations in foreign exchange rate when converting money from one currency to another on behalf of their customers.

Expensive recipient fees are generally charged on international transfers where the recipient bank has to convert the money into their domestic currency. To ensure this does not happen, GlobalWebPay converts the money into the domestic currency first, and then sends it onwards to the recipient bank. Consequently, no recipient fees should be charged for local currency payments, unless the recipient's bank account fee structure charges for local payments.

The recipient (person you are sending money to) will need a bank account in the destination country. You need a bank account in the country you wish to send money from.

GlobalWebPay delivery times are calculated using working days. As bank and religious holidays are not working days, then payments will be processed the following working day. Payments will be affected by bank and religious holidays in both the senders and recipients’ respective countries.

There are two typical reasons for a payment not being completed successfully:

1. If you funded the transaction via a bank transfer, then the funding required to complete the payment hasn’t yet arrived at GlobalWebPay’s bank account. Non-arrival may be down to a number of reasons:

- You left it a while before sending the money from your internet banking – or indeed may possibly have forgotten to send it

- Your bank hasn’t sent funds onto GlobalWebPay promptly

- You omitted the required reference into the payment reference field – and hence we cannot identify the payment as being sent by you

- You entered the wrong funding account details for GlobalWebPay’s bank account (e.g., account name or number)

- There has been a weekend and/or a bank holiday in between. For example, if you make an internet payment on a Friday night before a Monday Bank Holiday, your Bank may not send the payment until the following Tuesday

You can check on the reason by logging into your GlobalWebPay account and checking the status of the order. If it is showing as “Pending” and it is over 3 business days since you sent the funds, then please send an email to support@globalwebpay.com to raise the issue. Your email should include all the relevant payment information, including your account name, any payment reference, the amount & date sent as well as the bank used. This information will make it much easier for GlobalWebPay’s Customer Support to check our systems for this payment.

2. Your funding has been received and the payment may have left GlobalWebPay, but the recipient may not yet have received it.

- The account number or name you provided may not match that of the intended recipient* – in which case the overseas bank may return the payment or just be holding on to it

- The recipient may have received it in their bank account, but not recognise it. They may expect to see your name as payee – but see a payment coming from one of our outsourced payment partners such as “WorldPay AP” which they don’t recognise – in which case do ask your beneficiary to double-check their account

- The recipient’s bank may be holding onto the payment for some reason, such as a compliance query, and they may need to contact their bank to get the payment released to them

You can check on the reason by logging into your GlobalWebPay account and checking the status of the order. If it is showing as “Complete” and it is over 3 business days since the payment was sent, then please send an email to support@globalwebpay.com to raise the issue. Your email should include all the relevant payment information, including your account name, any payment reference, the amount & date sent as well as the bank used. This information will make it much easier for GlobalWebPay’s Customer Support to check their systems for this payment.

* To avoid the possibility of payments being returned by an overseas bank, you do need to enter the exact bank “account name” as provided to you by the recipient – for example if the account is in the name of “Herr Friedrich Smit”, then this should be entered when you set up the recipient - it should not be entered as “F Smit”. The degree of bank account name checking does vary from country to country, but in many countries the rule is strictly applied.

Your account limits are linked to your account level. You can make unlimited payments up to and not exceeding the total monthly value of your account. To find out your account level, please view your account profile for more details.

Account Level Transaction Fee Account Limit

For individuals:

Introductory User From £1 Transfers up to a total of £600.00 (minimum transfer of £2.00)

Standard Account From £1 Transfers up to a monthly value of £10,000 (minimum transfer of £2.00)

Premium Account From £1 Transfers up to a monthly value of £25,000 (minimum transfer of £2.00)

Super Premium Account From £1 Transfers up to a monthly value of £250,000(minimum transfer of £2.00)

For larger amounts please contact us

For Businesses:

Business Introductory From £1 Transfers up to a total of £700.00 (minimum transfer of £2.00)

Business Standard From £1 Transfers up to a monthly value of £75,000 (minimum transfer of £2.00)

Business Premium From £1 Transfers up to a monthly value of £250,000 (minimum transfer of £2.00)

Business Super Premium From £1 Transfers up to a monthly value of £1M (minimum transfer of £2.00)

For larger amounts please contact us

To obtain a Standard Account, log in and navigate to your profile page. Click on the upgrade option and follow the on-screen instructions. Please note that you may need to provide additional documentation to obtain a Standard Account – you can do this by uploading them on the site or emailing them to support@globalwebpay.com

Please do not send any documentation via post.

You can upgrade your account at activation or at any time thereafter.

You can make large single payments using GlobalWebPay if, for example, you wish to buy a property abroad. Please contact us for more details (support@globalwebpay.com) and we will offer you a competitive foreign exchange rate quote. Our compliance team will require additional information about the nature of the payment.

Your default currency is linked to your country of residence and will determine the bank details we provide you.

Canadian transit numbers are regulated by the Canadian Payments Association. A number has the following form:

XXXXX-YYY

where XXXXX is a Branch Number, and YYY is an Institution Number. As a general rule, Bank institution numbers start with 0, 2, 3, or 6, Credit Union and Caisse Populaire institution numbers start with 8, and Trust Company institution numbers with 5.

Some typical Institutions are:

- XXXXX-001 Bank of Montreal

- XXXXX-002 Bank of Nova Scotia

- XXXXX-003 Royal Bank of Canada

- XXXXX-004 Toronto-Dominion Bank

- XXXXX-006 National Bank of Canada

- XXXXX-010 Canadian Imperial Bank of Commerce (includes President's Choice Financial)

- XXXXX-016 HSBC Canada

- XXXXX-030 Canadian Western Bank

- XXXXX-039 Laurentian Bank of Canada

1. Can I use GlobalWebPay for business transfers to Pakistan?

GlobalWebPay’s service is designed for sending money to family and friends — unfortunately we are unable to provide transfers to businesses or charities.

However, we are also licenced to make payroll payments to recipients Pakistan

2. What is the maximum amount I can send?

The maximum limit per transfer is PKR 500,000 (Pakistani Rupee)

3. Can I send a larger payment?

Please contact us should you wish to make larger payments

You can also send larger amounts in USD or EUR for which we use the SWIFT payment network. In this situation the recipient will need an account capable of receiving foreign currency. Please contact us for more information.

4. What is GlobalWebPay’s relationship with Bank Alfalah?

GlobalWebPay works with Bank Alfalah, one of the largest banks in Pakistan, to make fast payments into the bank accounts of individuals. Bank Alfalah are connected to the majority of banks in Pakistan enabling the prompt settlement of payments.

See the full list of all banks connected to the service below:

|

Bank Code |

Bank Name |

Identifier |

|

00 |

khushhaliBank Limited |

KHBL |

|

01 |

Allied Bank Limited |

ABPA |

|

02 |

Habib Bank Limited |

HABB |

|

03 |

MCB Bank Limited |

MUCB |

|

91 |

MCB Islamic Bank (MIB) |

MCIB |

|

04 |

National Bank of Pakistan Limited |

NBPA |

|

05 |

United Bank Limited |

UNIL |

|

07 |

JS Bank Limited |

JSBL |

|

08 |

Bank Alfalah Limited |

ALFH |

|

09 |

Dubai Islamic Bank Limited |

DUIB |

|

10 |

Habib Metropolitan Bank Limited |

MPBL |

|

100 |

Apna Microfinance Bank |

APNA |

|

101 |

U Microfinance Bank |

UMBL |

|

102 |

Mobilink Microfinance Bank |

WMBL |

|

103 |

ICBC |

ICBK |

|

104 |

NRSP |

NRSP |

|

11 |

Summit Bank Limited |

SUMB |

|

12 |

Silk Bank Limited |

SAUD |

|

13 |

NIB Bank Limited |

NIBP |

|

15 |

SAMBA BANK LIMITED |

MBPL |

|

16 |

Meezan Bank Limited |

MEZN |

|

17 |

Bank Islami Pakistan Limited |

BKIP |

|

18 |

Bank Al-Habib Limited |

BAHL |

|

19 |

Soneri Bank Limited |

SONE |

|

21 |

Faysal Bank Limited |

FAYS |

|

22 |

Askari Bank Limited |

ASCM |

|

23 |

The Bank of Punjab |

BPUN |

|

25 |

SINDH BANK Limited |

SIND |

|

26 |

Bank of Khyber |

KHYB |

|

28 |

Al Baraka Bank Limited |

AIIN |

|

89 |

Telenor Bank |

TMFB |

|

92 |

Standard Chartered Bank |

SCBL |

|

99 |

First Women Bank Limited |

FWOM |

|

29 |

SadaPay |

SADA |

5. Is the receiver required to hold a bank account with Bank Alfalah?

No, the receiver can have a bank account with any bank in Pakistan shown in the list below.

7. How long will it take for funds to arrive with the beneficiary?

Using our trusted partner Bank Alfalah, GlobalWebPay allows almost instant deposits to most banks in Pakistan* 24/7/365.

8. Are there any compliance requirements specific to making payments to Pakistan?

GlobalWebPay require a picture or scan of the usual photo ID such as a Passport.

Additionally, we require a proof of address which must be the bank statement for the account that you intend to use to make your funding payments to us.

This account must be in your own name, or company name (if the sending party is a business) and show an up-to-date address.

If you do not provide this, or provide a statement for an alternative account, your payment will be held until the correct statement is provided.

GlobalWebPay is registered with the SARB to enable us to provide a local payment service into South Africa. As part of that registration, we are required to partner with a local bank. GlobalWebPay have partnered with Bidvest Bank as the provider of currency and accounts

The operational part of the service is managed locally by E4F who run the operations and act as customer liaison, ensuring all the documentation is in place to facilitate the prompt processing of payments into the recipient accounts. The key to successful payments into South Africa is the completion of a mandate form. More information on this is shown below.

1. What’s the SARB (South African Reserve Bank) reporting mandate form?

The first time your recipient receives money each year, they’ll need to complete a SARB (South African Reserve Bank) reporting mandate form. It’s required to be renewed annually.

2. Why is the reporting mandate form required?

The South African Reserve Bank requires the recipient of funds in South Africa to sign a reporting mandate confirming the details and nature of the funds received from overseas. This only takes a minute to complete, is done electronically, and once completed there is no need to call your bank to receive funds, which will be delivered without further action required.

3. When does the recipient get the mandate form?

Your recipient will get an email from E4F (Exchange4free), who are our administration partner in South Africa. The email will contain a link to the form online. If your recipient does not receive this email, they can call Exchange4Free at 011-453-7818 or email reporting@exchange4free.co.za. Once the mandate form is signed and processed, money will be deposited into your recipient’s account by the next working day.

The front of the mandate form looks like this:

4. It is critical to ensure the sender uses the correct details for the bank account otherwise the payment will be cancelled by Bidvest

5. How long will it take for funds to arrive with the beneficiary?

Payments should be received by the next working day once a mandate is in place

6. Are there any recipient fees taken?

No, as a result of signing the mandate form, the exact amount you send in ZAR will arrive in the beneficiary account.

We send money to the USA using a local internal payment method – the ACH network. Money is sent from funds we maintain in a US bank account to the beneficiary’s US bank account using the internal domestic ACH network – similar to the UK BACS system.

In order to set up a successful payment for the US you will need to provide the bank account ABA Routing Numbers for an ACH transfer – not a wire transfer (wire transfers are used for international payments from abroad – e.g., SWIFT – or fast internal payments – similar to the UK CHAPS service).

For larger US banks there will be multiple ABA Routing Numbers

As an example, the Bank of America quote on their website ABA Routing Numbers for all their branches (https://www.bankofamerica.com/deposits/resources/faq-routing-numbers.go) All branches share the same ABA Wire Transfer number but have unique ABA numbers by state – e.g. for branches in the Washington DC, then they show as:

Bank of America ABA Routing Number:

Washington DC

Electronic (ex. Direct Deposit/Automatic Payment): 054001204

Wire Transfer: 026009593

For smaller US banks

Many US banks don’t have correspondent bank links for foreign payments, so when US residents believe you are sending money from abroad, they often quote a route using an intermediate, larger bank and its ABA Routing Number. This will not work with our ACH service. You will need the ABA Routing Number of the target bank for the account you are paying into.

An example, here is the advice given by the bank to send money to an account with the City and Police FCU in Florida:

“Here is the sequence you need to follow to send the money:

First, the money is sent to: Southeast Corporate Federal Credit Union, in Tallahassee, FL with an ABA Routing number 263189069

Second, the money is then sent to the City and Police Federal Credit Union, Routing number 263079289”

The right ABA Routing Number to put into GlobalWebPay’s recipient details in this example would be the FCU’s one – 263079289.

Payments to Brazil in local currency (BRL) are subject to a number of compliance rules enforced by the Central Bank so it is vitally important to ensure all the correct documentation is in place.

Documentation should be provided at the same time you set up the payment with us and should be provided by email. If the relevant documentation is not provided in a timely manner this could result in your payment being held or rejected once it reaches Brazil.

Once the correct documentation is in place any future payments to the same recipient should flow through in a timely manner.

Please see below for a list of limits and the associated documentation required.

Limits for which documentation is requested:

• BR - Transaction USD Limit 3000

• BR - Same Account Monthly USD Limit 6000

• BR - Same Document Monthly USD Limit 6000

• BR - Same Email Monthly USD Limit 6000

In addition to the above, there are other limits depending on the type of payment and amount:

• Money remittances: limited to 10.000 BRL per payment by the Bank of Brasil

• Payments between 10.000 BRL and 3000 USD: If they are for a service, we should be able to process them, as soon as there is an invoice and an agreement. We check this individually.

• Payments over 3.000 USD: A Cadastro is required unless they are for a service provided on an online platform. For both scenarios it has to be for a service.

Cadastro Requirements

There are two types of Cadastro; one for an individual (PF) and one for a legal entity / company (PJ)

- PF (natural person)

• ID

• CPF (the document not the number)

• Proof of address with no more than 3 months old

• IRPF Declaration

• Invoice for the payment

• Agreement for the payment which has to have the same amount or a bigger amount than the invoice

• Place of birth

• Telephone number with the international dialling code

• Marital status and, if the person is married, the name of the partner

- PJ (legal person / organisation)

• The operating agreement of the company

• Balance sheets signed by the administrators & accountants

• ID of every director &/OR beneficial owner of the company

• Proof of address with no more than 3 months old from every director &/OR beneficial owner

• CPF of every director &/OR beneficial owner

• CNPJ (the document not the number) of the company

• IRPF declaration of every director &/OR beneficial owner of the company

• IRPF declaration of the company

• Agreement between the payer and the beneficiary who is receiving the funds (checking that amounts can never be less than the invoices)

• Invoices for the payments

• Names of the beneficial owners &/OR directors of the company

• Emails of the beneficial owners &/OR directors of the company

• Place of birth of the administrators &/OR directors of the company

• Telephone number with the international characteristic of every director &/OR beneficial owner

• Marital status and, if the person is married, the name of the partner of every director &/OR beneficial owner.

For every transaction the bank may ask for additional information that is not listed. The bank will ask for a registration, and depending on the amount and the provider, one signature or two signatures are going to be asked; if we create a registration for a person/company to receive payments, in further payments with providing agreements & invoices, it should be fine, but, again, the bank may ask further info if needed.

Documentation for payment

- Nota fiscal / Invoice (payment has to be for the same value in BRL as shown on the invoice).

- Contract for Services between the payer and recipient

Note: The bank may ask for further documentation/information if considered necessary

Changes to Thai regulations concerning international electronic transfers (IACH).

Due to a recent regulatory update issued by the local regulator impacting all Thai Financial Institutions, payment processing via the ACH clearing channel (SMART) will be disallowed from 21 October 2021. This regulatory update is a result of changes to local anti-money laundering practices for international electronic transfers.

What is the overall impact due to the revised changes in THB processing?

Following the suspension of SMART payment processing, transactions will be processed via alternative routes. Payments up to THB 49,999 delivered to beneficiary banks that are part of the PromptPay network will continue to be processed on a real-time basis.

All other payments will be processed using the SWIFT network and will therefore require two days to arrive with the beneficiary. Please note, there is no change in information required to initiate a payment.

This change in routing will only impact the following payments:

a. Transactions of THB 50,000 and above

b. Transactions to beneficiary banks that are not part of the PromptPay network; see list of banks below:

Bank Code Bank Name

026 MEGA INTERNATIONAL COMMERCIAL BANK PCL (MEGA ICBC)

027 BANK OF AMERICA NATIONAL ASSOCIATION (BA)

045 BNP PARIBAS, BANGKOK BRANCH (BNPP)

052 BANK OF CHINA LIMITED, BANGKOK BRANCH(BOC)

079 ANZ BANK (THAI) PUBLIC COMPANY LIMITED (ANZ)

080 SUMITOMO MITSUI TRUST BANK (THAI) PCL (SMTB)

This change is effective from Thursday 21st October 2021

A major requirement of FCA Regulation is the Safeguarding of Client Funds. This was put in place to protect consumers from the effects of financial loss in the case of a financial services provider ceasing to trade. The relevant regulations state that all client funds must be segregated from all other funds, such as corporate, and must be held in a designated Client Fund Account that cannot be used for any other purpose. Alternatively, client funds can be covered by a suitable insurance policy.

This document provides information on the GlobalWebPay (GWP) policy and procedure in respect of the handling of customer funds, and the reconciliation of those funds to meet regulatory standards.

The key areas of client fund management are the receipt, segregation, holding, reconciliation and pay-out to meet standards set down by the FCA. This document details GlobalWebPay’s approach to each of these areas.

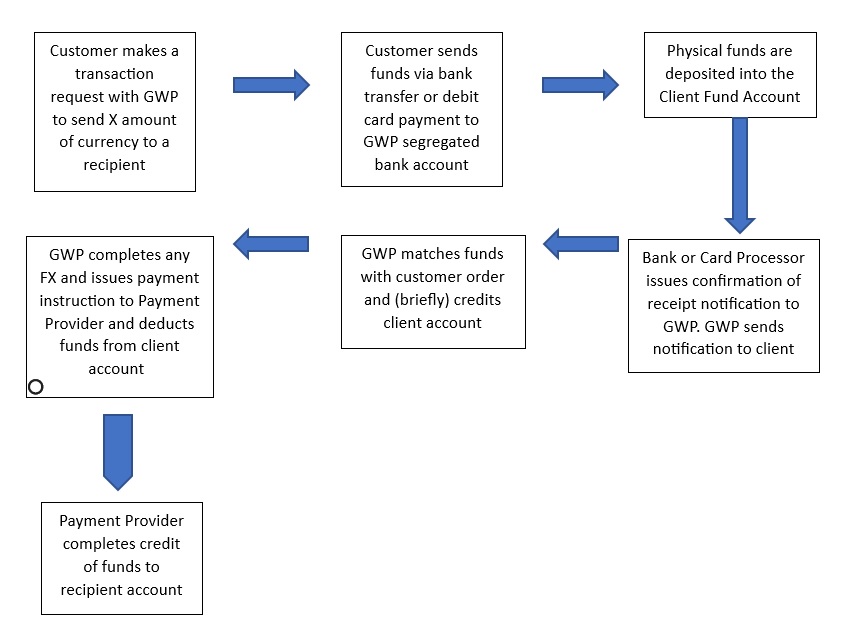

The diagram below gives an overview of the funds flow, which is expanded upon in the following sections.

Process

GWP has opted to segregate customer funds on receipt, rather than take out an insurance policy. All customer funds are held in a Client Fund designated bank account until such time as they are required for settlement of a customer payment instruction. GlobalWebPay utilises bank accounts in Lloyds Bank for receipt of clients funds. GlobalWebPay also maintains liquidity at various Payment Providers for the payment of client transfers to recipients. These Payment Providers operate under contract with GlobalWebPay and are responsible for parts of the process, under the oversight of GlobalWebPay.

All customer funds received for onward transmission to the recipient are required to be cleared funds prior to processing and are accompanied by a prior transfer request from the customer. Funds are not retained by GlobalWebPay or a Payment Provider for an extended period of time and are generally processed to the recipient within one working day, normally in hours.

GlobalWebPay maintains funds in a number of currencies. In these cases, the GBP funds are utilised to purchase foreign currency which is also deposited straight into Client Fund Accounts at Payment Providers. At all times, GlobalWebPay holds client funds which are sufficient to meet all liabilities to customers.

Receipt and Segregation of Funds

GlobalWebPay only receives funds from customers by bank transfer or debit card. The receiving bank account details used will refer to the Client Fund Account, enabling direct payments into that account. Funds will remain in the Client Fund Account until such time as they are utilised by GlobalWebPay to process the customer instruction.

The Client Fund Account will not be used for any other purpose.

Bank transfers arrive into the Client Fund Account and are therefore cleared funds. With regard to debit card payments, Checkout.com (our Card Processor/Acquirer) deposits the funds into the Client Fund Account as soon as card authorisation is obtained.

On receipt of funds, Lloyds or Checkout.com sends a notification that the funds have arrived, providing the relevant reference numbers from the payment. This enables GlobalWebPay to match up the funds with the payment instruction.

Multiple bank accounts may be used for the purposes of safeguarding client funds in order to facilitate different currencies and regions, and as mentioned above, GlobalWebPay will, at all times, hold sufficient funds to meet all of its liabilities to its customers.

As stated above, the bank account used for the holding of customer funds has to be designated as a Client Fund/ Segregated Account by the holding bank. This is a regulatory requirement and is necessary to ensure that no other transactions are processed through that account and that no persons other than the relevant customers have any claim on those funds.

This has been put in place to ensure consumer protection in the case of the failure of the company. GlobalWebPay fully adheres to this requirement. The only transfer activity between the client fund accounts and GlobalWebPay’s corporate accounts is the retrieval of fees from customer transactions which are owed to GlobalWebPay for the services provided. These fees do not impact on the liabilities GlobalWebPay has to its customers.

The reconciliation of Client Funds is a key area of regulation, and a robust process and tight controls exist to give comfort to the business that it is able to discharge its financial responsibilities to our customers.

GlobalWebPay holds full records of all payment requests from customers, including those that are outstanding. Once funds are received, they are matched up with the outstanding order and processed. Reconciliation is only required on payments that are outstanding once funds are received. GlobalWebPay is fully aware of which customers these affect, and these situations would relate to payments that have not yet been processed by a payment partner, and are queued within the system ready to be sent. The balance in the Client Fund Account represents these customers. Sufficient records of the Client Fund Accounts are maintained and a full breakdown of transactional data is held by GlobalWebPay for comparison when necessary. Instructions given by customers that have not yet been funded do not form part of the reconciliation process as no funds have been received, and therefore do not require segregation.

Should any inconsistency arise as a result of the reconciliations process, GlobalWebPay will immediately identify the reason for the inconsistency in the figures, and correct it as soon as possible.

Once funds have been received to the Client Fund Account, GlobalWebPay identifies the relevant customer from the payment reference number and matches the deposit to their order. Once all of the details have been checked, GlobalWebPay issue a payment instruction back to a Payment Provider to process the transaction. These requests are then queued within the Payment Provider system for processing - dependent on the currency involved. These are made within one working day.

GlobalWebPay operate a dual-approval policy to all payments. Two members of the GlobalWebPay staff are required to review payments prior to processing. Any payments deemed to be fraudulent or unusual are not sent for processing until an investigation has been completed.

Occasionally GlobalWebPay receive funds that cannot be allocated to an instruction. These only relate to bank transfers as card transactions would fail unless all correct required data is provided. GlobalWebPay investigate these payments to locate the relevant customer, using sending bank details, amounts and outstanding instructions to locate the customer. In these cases, the funds are moved to an ‘unapplied account’ until such time as the customer can be located, at which time the payment is processed.

In addition to this, customers occasionally overpay when making the transfer in respect of an order. In these cases, all overpaid funds are returned to source, be that card or bank account.

Reimbursement

The currency of any reimbursement is £ Sterling (GBP)

The reimbursement period in case of failure is within 30 working days

Reimbursement exclusions

Reimbursements cannot be made if there is a suspicion of the incoming payment being associated with money laundering or fraud or is subject to any investigation by an agency involved in law enforcement.

This document highlights GlobalWebPay’s approach to the safeguarding of client funds. The Board is responsible for incorporating and maintaining this policy and ensuring it effectively manages GlobalWebPay’s regulatory and business requirements as the service evolves.

Last Reviewed: 25 September 2024